reverse tax calculator australia

Finally Your Take Home Pay after deducting Income Tax and Medicare. To work out the cost including GST you.

Age Pension Calculator Noel Whittaker Interest Calculator Wealth Creation Investing

Calculate tax figures in Australia for the financial year ending in 2020.

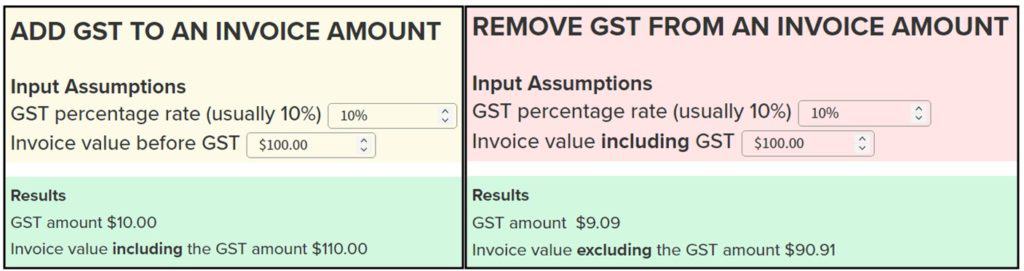

. This Calculator will display. To calculate Australian GST at 10 rate is very easy. In summary the GST rate of 10 will be charged on most goods and services consumed in Australia.

Each calculator provides the same analysis of pay but is simplified to allow you to enter your Australia salary based on how you are used to being paid hourly daily etc. To get GST inclusive amount multiply GST exclusive value by 11. Firstly everyone can earn a certain amount of tax-free income known as a tax-free threshold.

This tool calculates the change in cost of purchasing a representative basket of goods and services over a period of time. Pre-decimal inflation calculator. Your marginal tax rate.

3572 plus 325c for each 1 over 37000. 75 of goods 750 GST 8250 total. This method of calculating withholding PAYG income tax instalments can vary from the annual tax amounts.

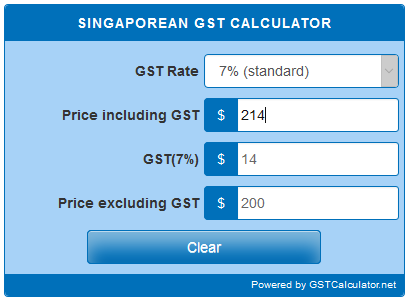

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price. Amount without sales tax GST rate GST amount.

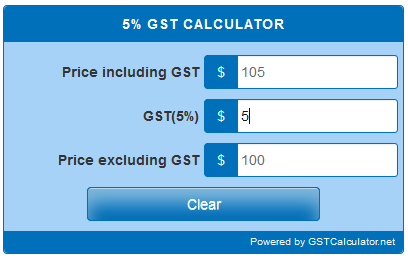

500 is GST exclusive value. The GST rate is normally 10 of taxable value. To add GST multiply the price by 11.

75 of goods x 10 GST 750 GST. Differences will always be in favour of the ATO however these will be. And provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly.

Net to Gross Calculator - Rise High. The cost of GST is then added to the purchase. The calculator will work out how much tax youll owe based on your salary.

No allowance is made for tax deductions Medicare or other levies andor payments. This easy-to-use calculator can help you figure out instantly how much your gross pay is based on your net pay. Requirement to reverse charge GST.

19822 plus 37c for each 1 over 87000. Tax on this income. For more information see.

Price before Tax Total Price with Tax - Sales Tax. Amount without sales tax QST rate QST amount. This Australian GST calculator adds 10 to determine a GST-inclusive amount and also allows a reverse calculation to determine an included GST amount or the price without GST included.

JAWs Australian tax calculator with reverse lookup for end of financial year 2020. Sales Tax Rate Sales Tax Percent 100. This calculator can also be used as an Australian tax return calculator.

For example it may show that items costing 10 in 1970 cost 2693 in 1980 and 5871 in 1990. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Simply enter any one field press the calculate button and all the other fields will be derived.

Adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky. Using the Australian salary calculator is easy. When working out your take-home pay the salary calculator assumes that you are not married and have no.

Simply enter your Gross Income and select earning period. 19c for each 1 over 18200. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Formula How to calculate GST formula GST is calculated by multiplying the GST rate 10 in Australia by the total pre-tax cost. Reverse Sales Tax Calculations. Our calculator will take between 2 and 10 minutes to use.

How to calculate reverse GST formula. The rates are obtained from the Australian Taxation Office ATO. How much Australian income tax you should be paying.

If you are registered for GST you need to include GST in the price you charge your customers for goods and services they purchase from you called sales. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. Post-tax deductions such as union fees payee superannuation contributions are deducted from your net pay that is after tax has been deducted from your gross pay a lump sum payment of back payments commissions or bonuses including leave loading that you received.

This calculator honours the ATO tax withholding formulas. Here is how the total is calculated before sales tax. Just multiple your GST exclusive amount by 01.

Note that it does not take into account any tax rebates or tax offsets you may be entitled to. To figure out how much GST was included in the price you have to divide the price by 11 1101110. 500 is GST exclusive value.

Simply enter your gross salary choose if youre being paid yearly monthly or weekly and let our site do the rest. Income tax on your Gross earnings Medicare Levyonly if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings. 500 01 50 GST amount.

GST Act Chapter 4. Youll then pay 19 on earnings between 18201 and 45000 325 on earnings between 45001 and 120000 and 37 on earnings between 120001 and 180000. For the 2022 2023 tax year the first 18200 you earn is tax-free.

Each pay calculator includes personal tax allowances calculates your pension and medical deductions etc. Canstars Income Tax Calculator calculates the tax payable on gross wages paid in equal weekly amounts. Margin of error for HST sales tax.

To find a price without GST reverse calculator divide the price by 11. What your take home salary will be when tax and the Medicare levy are removed. Pay Calculator Why this PAYG Calculator.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. The amount of the reverse-charged GST is 10 of the price of the purchase. 84-10 Reverse charge on offshore intangible supplies.

From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Reverse charge in the precious metals industry.

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

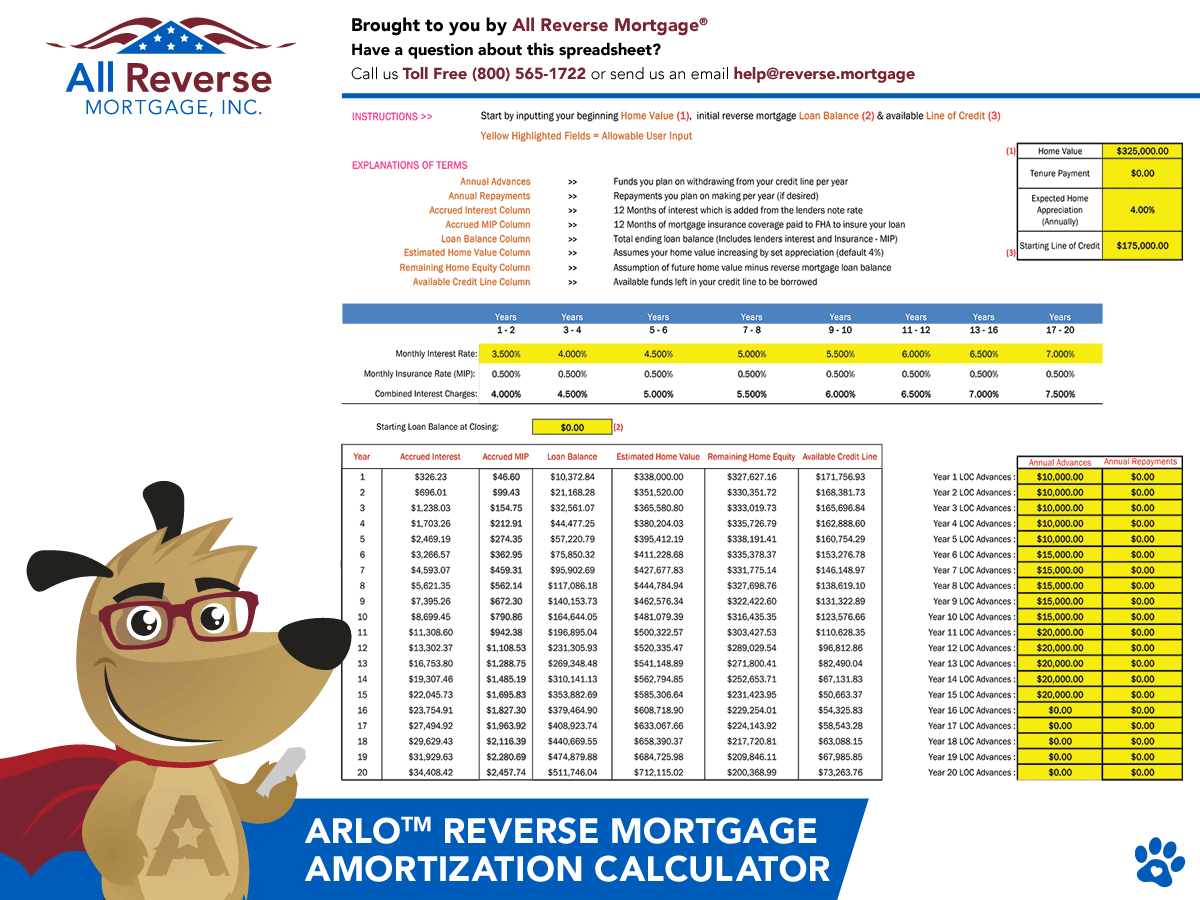

Free Reverse Mortgage Amortization Calculator Excel File

Gst Calculator Australia Atotaxrates Info

Your Vat Reverse Charge Questions Answered Freshbooks Blog

5 Percent Gst Calculator Gstcalculator Net

How To Calculate The Tax In Australia Quora

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Ugru Crm Vs Salesforce Vs Wealthbox Vs Redtail Vs Zoho For Mobile Email Calendar Workflows And Tasks Crm Financial Planner Financial Planning Organization

Singaporean Gst Calculator Gstcalculator Net

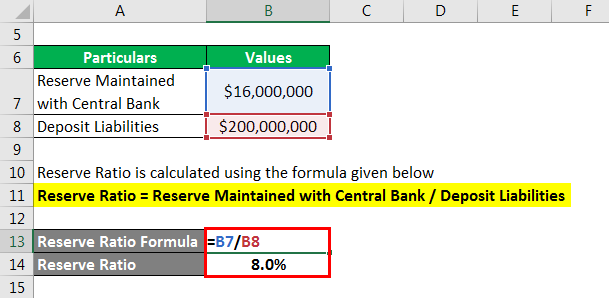

Reserve Ratio Formula Calculator Example With Excel Template

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

Reserve Ratio Formula Calculator Example With Excel Template

Reverse Percentages Calculator Online

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis

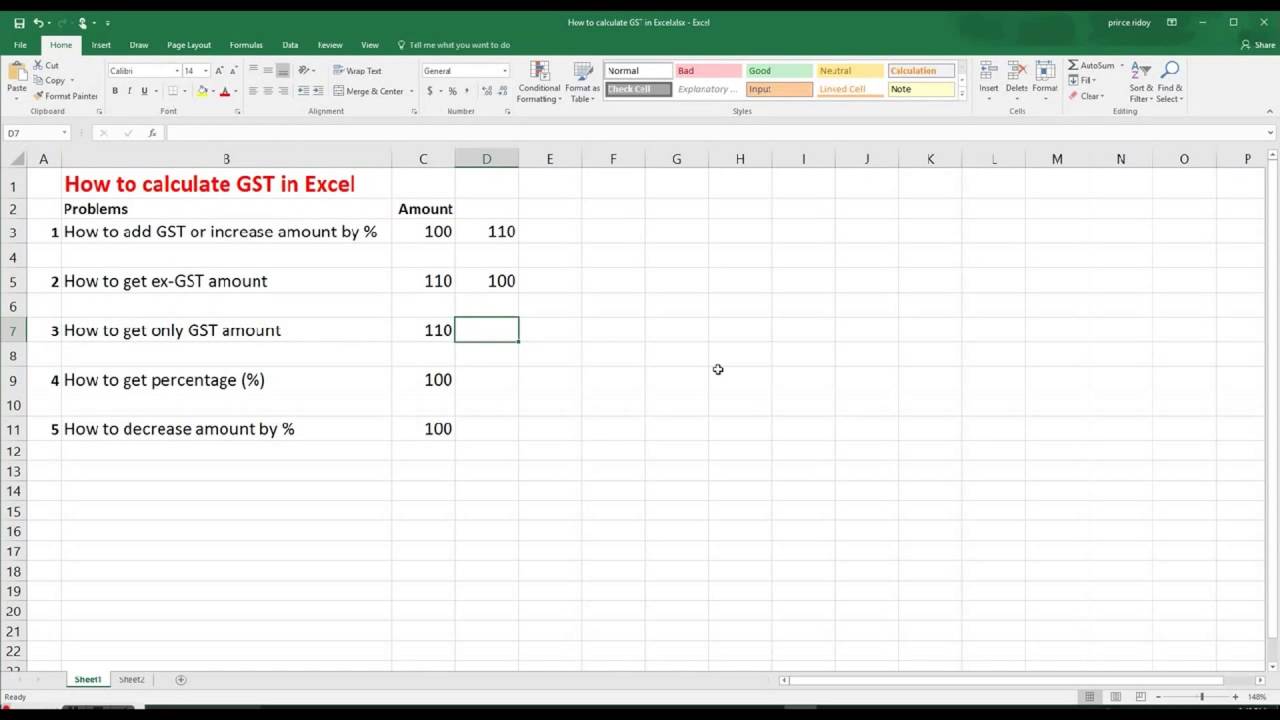

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube