reverse sales tax calculator texas

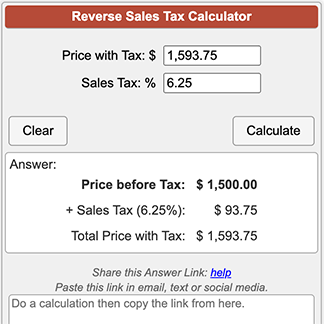

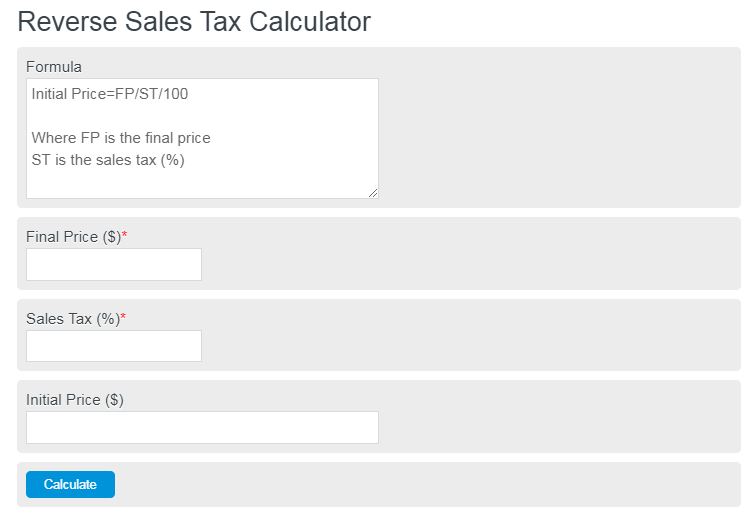

This script calculates the Before Tax Price and the Tax Value being charged. The formula looks like this.

How To Calculate Sales Tax Backwards From Total

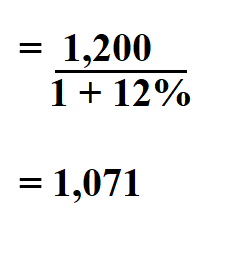

You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax.

. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes.

The formula looks like this. Divide the tax rate by 100. In Texas can a reverse mortgage be approved if.

The only thing to remember in our Reverse Sales. 1 0075 1075. Price before Sales Tax Final Price 1 Sales Tax If you need to use the Tax sales Calculator for several products at once it is handy to use Excel per formulas and.

Here is how the total is calculated before sales tax. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Formulas to Calculate Reverse Sales Tax.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Before-tax price sale tax rate and final or after-tax price. Add one to the percentage.

5590000 1075 5200000. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Current HST GST and PST rates table of 2022. In Texas prescription medicine and food seeds are exempt from taxation. See the article.

Average Local State Sales Tax. Subtract that from the receipts to get your non-tax sales revenue. Divide the final amount by the value above to find the original amount before the tax was added.

Input the Tax Rate. Amount without sales tax GST rate GST amount. Maximum Local Sales Tax.

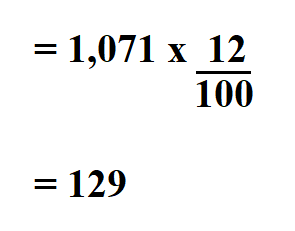

Amount without sales tax QST rate QST amount. The next step is to multiply the outcome by the tax rate it will give you the total sales-tax dollars. The reverse sale tax will be calculated as following.

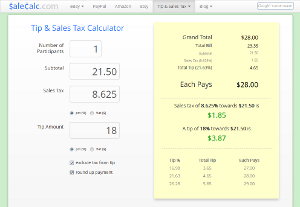

Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price. In Texas prescription medicine and food seeds are exempt from taxation. Add tax to list price to get total price.

Texas State Sales Tax. Reverse sales tax calculator texas Sunday May 1 2022 Edit. For example suppose your sales receipts are 1100 and the tax is 10 percent.

Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. You will pay 455 in tax on a 70 item. Not all products are taxed at the same rate or even taxed at all in a given.

Divide your sales receipts by 1 plus the sales tax percentage. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. List price is 90 and tax percentage is 65.

Divide the final amount by the value above to find the original amount before the tax was added. Add one to the percentage. Divide tax percentage by 100.

A tax of 75 percent was added to the product to make it equal to 42871. As we can see the sale tax amount equal to 5000 which the same to above calculation. Just enter the five-digit zip code of the location in which the.

The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Multiply the result by the tax rate and you get the total sales-tax dollars.

855-335-3500 New Car Sales. The base state sales tax rate in Texas is 625. Vermont has a 6 general sales tax but an.

So divide 75 by 100 to get 0075. And all states differ in their enforcement of sales tax. Divide 1100 by 11 and you get 1000.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 4287 1075 3988. Net Sale Amount Total Sale 1 sale tax rate 105000 105 100000.

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. We can not guarantee its accuracy. Multiply price by decimal tax rate.

A tax of 75 percent was added to the product to make it equal to 5590000. The price of the coffee maker is 70 and your state sales tax is 65. 70 455 7455.

Sale Tax total sale net sale 105000 100000 5000. To add tax to the price of an item multiply the cost by 1 the sales tax rate as a decimal. Maximum Possible Sales Tax.

Please check the value of Sales Tax in other sources to ensure that it is the correct value. Find your Texas combined state and local tax rate. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

Tax rate for all canadian remain the same as in 2017. So divide 75 by 100 to get 0075. Divide the tax rate by 100.

65 100 0065. 70 0065 455. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Texas has a 625 statewide sales tax rate but also has 998 local tax jurisdictions including. 1 0075 1075.

Texas Sales Tax Calculator Reverse Sales Dremployee

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Tip Sales Tax Calculator Salecalc Com

Reverse Sales Tax Calculator Calculator Academy

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

Quebec Tax Calculator Gst Qst Apps On Google Play